us japan tax treaty social security

3 Relief From Double Taxation. A minimum of 40 social security points or credits are required to.

Social Security Update Archive Ssa

I still live in Japan and.

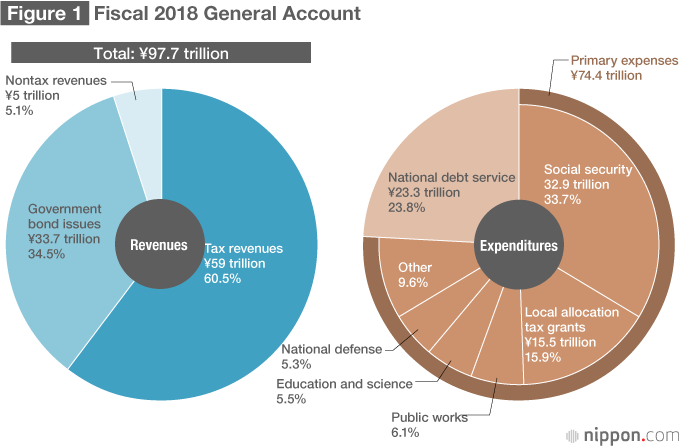

. An agreement with Japan would save US. Americans who retire in Japan can still receive US social security payments if they qualify to receive them. Workers and their employers about 632 million in Japanese social security and health insurance taxes over the first 5 years.

If you worked in the US. During that time I worked at Japanese corporations and dutifully paid into Japans social security system. 1 US-Japan Tax Treaty Explained.

IRS International Taxation Overview. I have lived in Japan for more than 30 years. The Japanese-US tax treaty provides that SS benefits by either country are only taxed by the country of residence.

4 Income From Real Property. The US Japan tax treaty is useful for defining the terms for situations when it is unclear to which country taxes should be paid. Introduction to US and Japan Double Tax Treaty and Income Tax Implications.

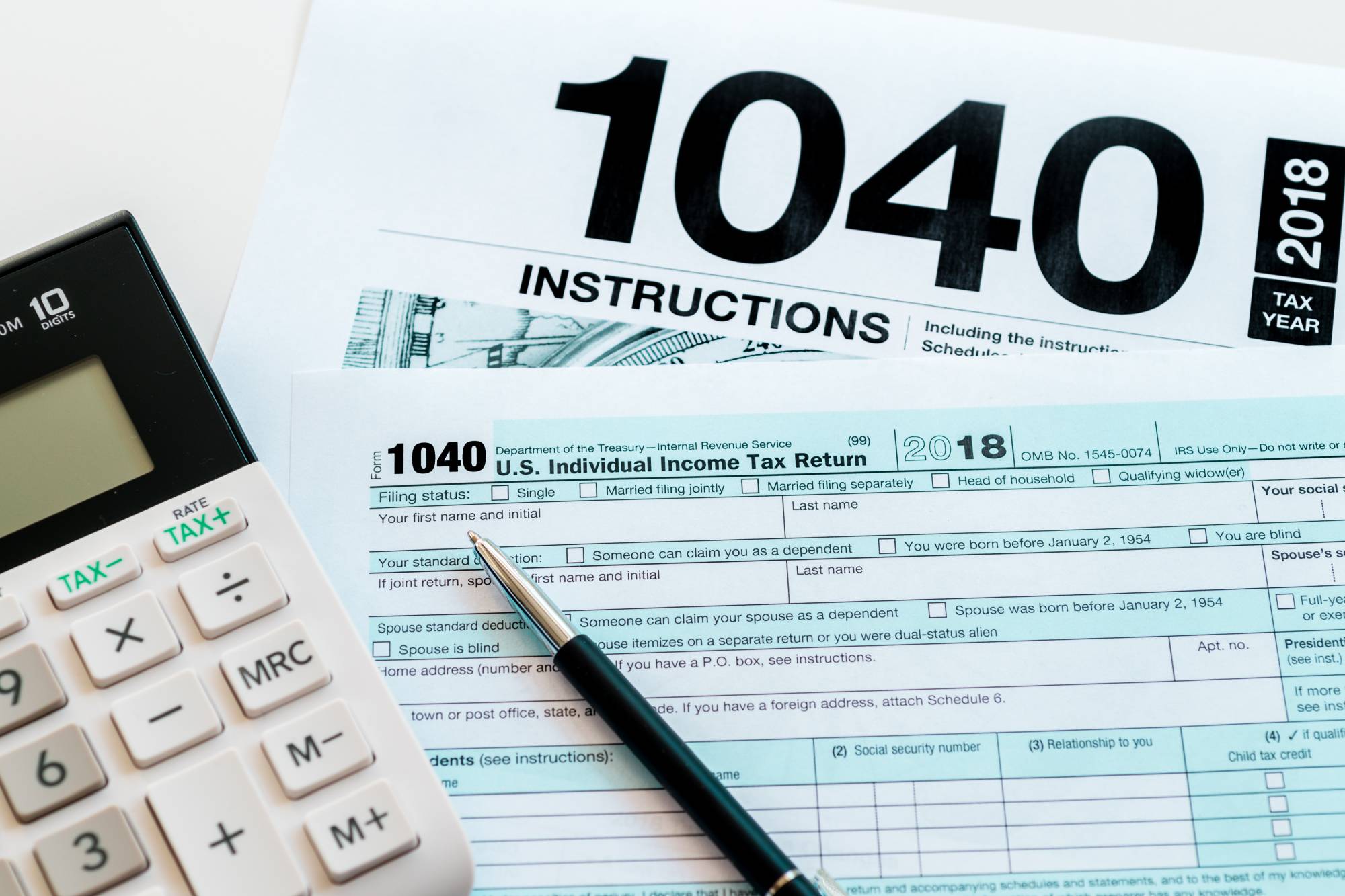

Technical Explanation PDF - 2003. This November Ill turn 63 and qualify to start receiving a Japanese Social. If you claim treaty benefits that override or modify any provision of the Internal Revenue Code and by claiming these benefits your tax is or might be reduced.

Income Tax Treaty PDF - 2003. Therefore if a US person earns public pension from work performed in Japan then they can claim that it is only taxable in Japan. Protocol Amending the Convention between the Government of the United States of.

For less than 10 years you may be eligible for benefits in accordance with the US-Japan Social Security Agreement aka Totalization Agreement. An agreement with Japan. Exemption on Your Tax Return.

I live in Japan and I have a few questions about US tax on my foreign social security pension. Individuals living abroad and who. It does not apply to a US Citizen or Permanent Resident of the.

The United States- Japan Income Tax Treaty contains detailed rules intended to limit its benefits to persons entitled to such benefits by reason of their residence in a Contracting State. 2 Saving Clause and Exceptions. Subject to the provisions of paragraph 2 of Article 18.

The country that receives. Protocol PDF - 2003. Social Security in Japan.

US Tax Treaty with Japan.

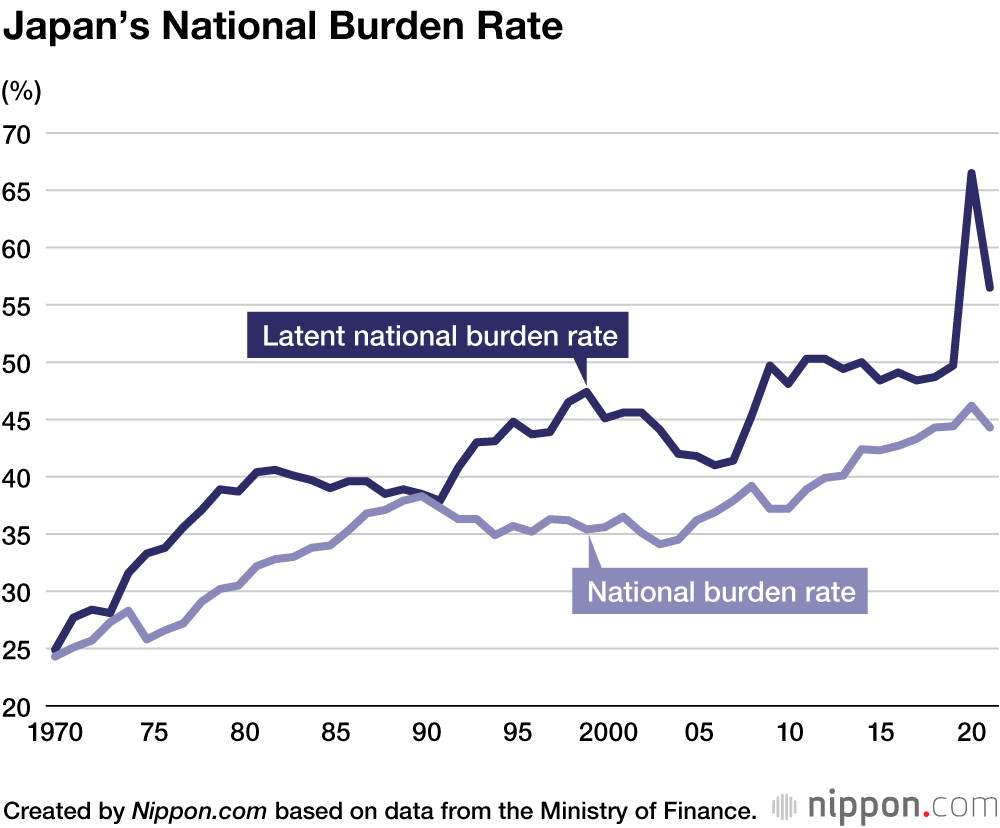

National Burden Taxes And Social Security Contributions In Japan Exceed 40 Of Income For Ninth Consecutive Year Nippon Com

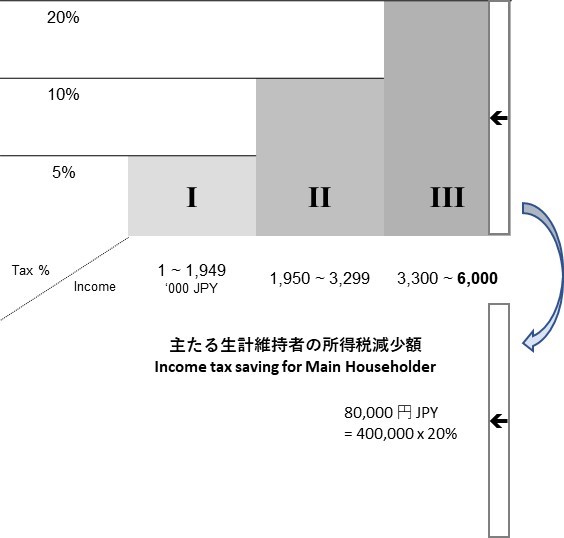

Social Security Tax Deduction For Social Insurance Premium Of Spouse Anshin Immigration Social Security

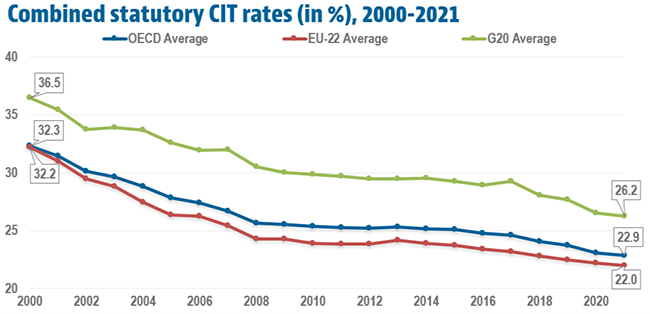

United States Taxation Of International Executives Kpmg Global

U S Estate Tax For Canadians Manulife Investment Management

Simple Tax Guide For Americans In Japan

Social Security Benefits For Noncitizens Everycrsreport Com

Form W 8ben Definition Purpose And Instructions Tipalti

National Burden Taxes And Social Security Contributions In Japan Exceed 40 Of Income For Ninth Consecutive Year Nippon Com

Japan Peo Employer Of Record Services Velocity Global

Federal Insurance Contributions Act Wikipedia

Japan Taxation Of International Executives Kpmg Global

Crypto Platform Navigates Tax Rules In Japan U S The Japan Times

Do Expats Get Social Security Greenback Expat Tax Services

Nonprofit Law In Japan Council On Foundations

U S Japan Social Security Totalization Treaty You Must Enroll In Japanese Health And Pension Hoofin

The My Number System In Japan And How It Affects Non Japanese Plaza Homes

Toward More Sustainable Social Security For Japan Nippon Com

How Scandinavian Countries Pay For Their Government Spending